Why are biotechs going SPAC?

Dear friends and colleagues,

As healthcare has been thrusted onto the world stage by COVID, biotech IPOs have gone off the roof. 2020 is on track to post the highest number of biotech IPOs in over 5 years.

As biotech demand increased, so has the number of biotech-focused SPACs. This article goes over what SPACs are and the advantages and disadvantages of SPACs for biotechs.

What are SPACs?

SPACs stands for “special purpose acquisition companies.”

Imagine SPAC as a blank check that investors has written to give to a manager of funds, called a “sponsor.”

A SPAC acts as a shell company. The sponsor has a limited period of time (usually ~1-2 years) to find a target within the specified amount of money raised.

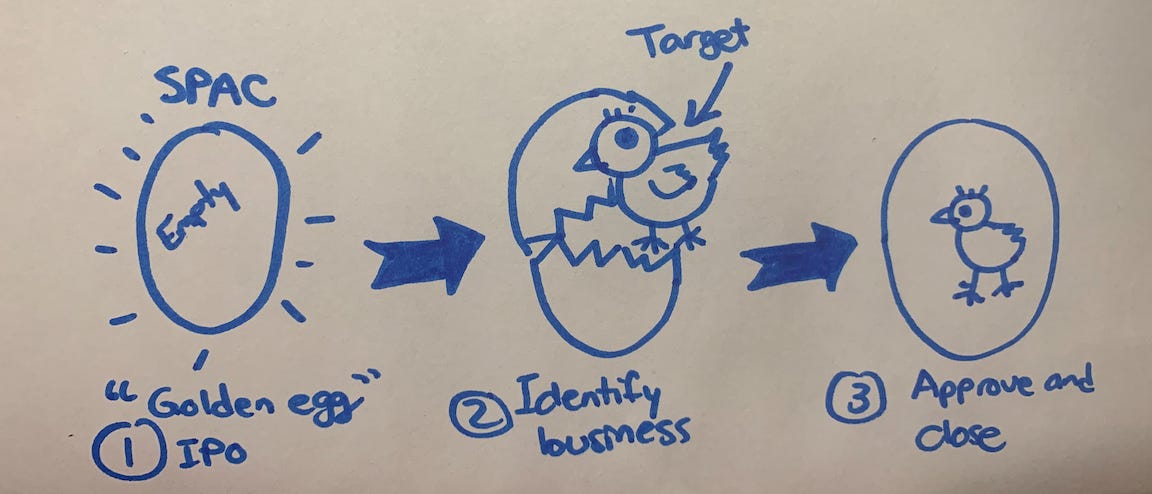

Exhibit 1: My hand-drawn analogy of a SPAC “a reverse egg hatch”

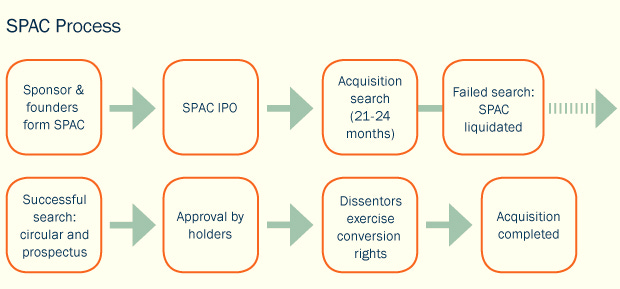

What does a typical SPAC timeline look like:

1. Start with IPO – SPACs goes through a streamlined IPO process

Incorporate SPAC and sell founder shares

Prepare and file S-1 with SEC and get underwriting agreements

IPO roadshow, pricing and closing

2. Identify a target business

Perform due diligence and identify target business

Prepare proxy filing

Sign acquisition – once a target company has been identified, the de-SPAC process begins

3. Approve and close

Finish and announce acquisition agreements

Get SPAC shareholder approval of transaction through majority shareholder vote

Redeem common shares for investors opting out and close the transaction

File Super 8-K with SEC

Advantages and Disadvantages of Biotech SPACs

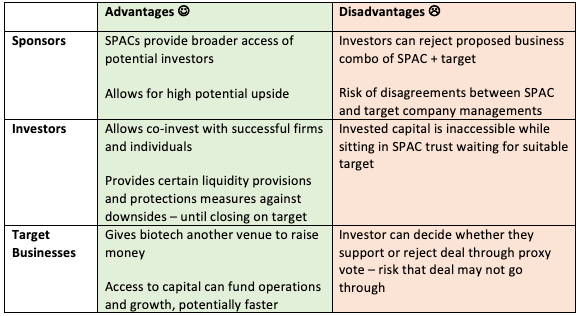

There are 3 main stakeholders involved in a biotech SPAC:

1) Sponsors who manage the SPACs

2) Investors that invest in SPACs

3) Target business acquired by SPAC

Biotech targets fall within the ~$100-$500M range, typically in clinical stage. Recently, KBL Merger Corp IV ($115M) has announced approval of the business combination of 180 Life Sciences Corp, which develops drugs for inflammatory diseases, fibrosis, and pain.

But, even pre-clinical stage biotech companies have been acquired by SPACs. What will be the future of biotech SPACs? Only time will tell…

Stay interested,

Kath

P.S. Today is the FDA hearing of the Pfizer vaccine, once the Moderna one is out on Dec 17, I’ll take a look and summarize some thoughts for you.

How to learn more on biotech SPACs:

It’s Raining Biotech SPACs!

https://www.forbes.com/sites/brucebooth/2020/10/15/its-raining-biotech-spacs/?sh=42c1edf15ca9

Billions of dollars worth of SPACs are riding on the biotech IPO boom:

https://endpts.com/spacs-are-riding-on-the-biotech-ipo-boom/

SPACs: What's a Special Purpose Acquisition Company?

https://blog.embarkwithus.com/spacs-whats-a-special-purpose-acquisition-company